Decoding Tax Forms: Info You Need To Know - The Form Explained

by Magnolia Pollich May 06 2025

Are you puzzled by tax forms and the seemingly endless stream of paperwork that arrives each year? Understanding the nuances of these documents, particularly those related to income and refunds, is crucial for financial well-being and avoiding potential headaches with the IRS.

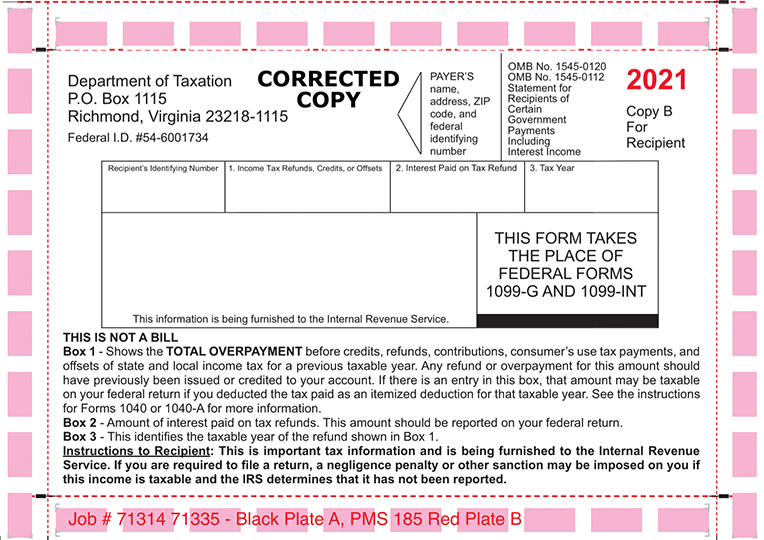

Navigating the complexities of tax season can be daunting. One particular form, often appearing in a seemingly innocuous postcard format, warrants careful attention. This unassuming document holds crucial information about your income and, importantly, any tax refunds you may have received.

Let's delve into the specifics. The form in question, a postcard, is designed to provide a concise overview of certain financial transactions. It's a snapshot of specific income elements that may be taxable, and its primary function is to keep both you and the IRS informed about these financial events. This document is required by the IRS under Section 6050E of the Internal Revenue Code, ensuring transparency and compliance with federal tax laws. The form's primary purpose is to inform both the taxpayer and the IRS about income received that may be taxable. Pay close attention, as the form often contains details about amounts. These amounts can include various forms of income.

- Discover Raphael Luce Age Net Worth Stranger Things Fame

- Daniil Kvyats Life Partner Penelope And F1 Drama Uncovered

One specific element you'll find on the postcard form is the Colorado income tax refund you received in the prior year. If you're a resident of the Centennial State, this is particularly relevant. The inclusion of this information on the form is designed to help you accurately report your income on your tax return. If your $593 is in box 2, it means you got a state income tax refund on your 2022 state income tax return. Therefore, it's crucial to learn what details are included on the form, when you should expect to receive it, and how to report this income on your tax return. These details will make sure that everything goes smoothly during tax season.

Where can you seek assistance if you need it? The Division of Unemployment Insurance Customer Service Lobby, located at 621 17th Street, Suite 100, Denver, CO 80202, is a valuable resource for information and support. They can provide guidance on a variety of topics related to unemployment benefits and associated paperwork.

For those who prefer a digital approach, the option to file your state income taxes online provides convenience and efficiency. Many states offer user-friendly online portals that streamline the tax filing process. Look for options to file your state income taxes online to make the process quicker and easier.

- The Ninth Gate 1999 Cast Crew And More Details

- Crisda Rodriguez Before Death A Fashion Designers Legacy

One key question that frequently arises is: How do I get copies of my tax returns? Accessing prior tax returns is essential for a variety of reasons, from preparing current tax filings to providing information to financial institutions. Similarly, the question of how to grant access to your accountant or tax preparer is equally crucial for ensuring smooth and accurate tax preparation. Many online accounts allow you to manage your benefits and provide access to your tax forms. Often you will have access to your tax forms online if there is an online account where you manage your benefits.

Navigating these situations often involves online accounts and secure portals. However, please read the form more carefully. Pay close attention to the details. You might find that the information on the form leads to answers for your questions.

Regarding specific items, such as unemployment benefits, they are generally categorized in Box 1 of the form. State income tax refunds, on the other hand, typically appear in Box 2. The distinction is important for accurate reporting and compliance.Unemployment benefits are in box 1. Not state income tax refunds, which are in box 2. If your $593 is in box 2, it means you got a state income tax refund on your 2022 state income tax return.

Consider the specifics: Colorado (CO) requires an account number. The format for Connecticut (CT) tax registration number is 8 digits and a hyphen, followed by 3 digits (e.g., 12345678-910). Ensure you have the correct information.

Finally, for those involved with unemployment claims, an exciting development is on the horizon. Active claimants will have a new option starting on January 2, 2025. Stay tuned for more details and take advantage of this upcoming enhancement.Active claimants will have this new option starting on january 2, 2025.

Detail Author:

- Name : Magnolia Pollich

- Username : roberto36

- Email : magdalena37@king.com

- Birthdate : 1996-04-20

- Address : 940 Arden Road North Kaleighside, VT 46584

- Phone : +14589017623

- Company : Bogisich LLC

- Job : Deburring Machine Operator

- Bio : Consequatur vel qui similique. Blanditiis suscipit praesentium et et quis ratione quia.

Socials

instagram:

- url : https://instagram.com/baby.harris

- username : baby.harris

- bio : Ut modi vel illo voluptas. Beatae ipsum enim cupiditate. Et deserunt esse quia.

- followers : 2475

- following : 957

facebook:

- url : https://facebook.com/babyharris

- username : babyharris

- bio : Nihil corporis impedit dolore nemo nostrum sunt id.

- followers : 117

- following : 2031

linkedin:

- url : https://linkedin.com/in/bharris

- username : bharris

- bio : Quae sequi alias incidunt soluta.

- followers : 5811

- following : 437

twitter:

- url : https://twitter.com/bharris

- username : bharris

- bio : Quia quasi libero nisi. Quaerat ut aut et et harum. Sit ad ab tempora libero eos. Ut ea cum sit maxime.

- followers : 4815

- following : 109

tiktok:

- url : https://tiktok.com/@baby3635

- username : baby3635

- bio : Ut deserunt eaque debitis nisi earum in. Quos repellendus corrupti ad amet.

- followers : 1974

- following : 1891