Understanding Your State Tax Refund: A Complete Guide To 1099-G & More

by Sasha Schulist May 03 2025

Are you prepared to navigate the complexities of tax refunds and ensure accurate financial reporting? Understanding the nuances of state and local tax refunds is critical for taxpayers aiming to avoid potential discrepancies and ensure compliance with tax regulations.

The world of taxation can often feel labyrinthine, and the intricacies surrounding state and local tax refunds are no exception. Many individuals find themselves grappling with the proper way to handle these refunds, particularly when it comes to accurately reporting them on their federal tax returns. This is where a keen understanding of the rules and regulations becomes paramount.

One of the first things to consider is the potential taxability of a state or local tax refund. According to the "tax benefit rule," if a taxpayer received a benefit from deducting state and local taxes in a prior year, any refund received in a subsequent year must be reported as income. This essentially means that if you itemized deductions on your federal return and benefited from deducting state and local taxes, a refund you receive in the following year might be considered taxable income. The amount that is taxable is typically the portion of the refund that corresponds to the deductible amount from the previous year.

- Everything You Need To Know About Nyc Prep Episodes More

- Before Death The Last Words Of Fashion Icon Crisda Rodriguez

For those who itemized deductions, a key step is reviewing your previous year's tax return. This will allow you to determine the exact taxable portion of your refund. The refund amount should be reported accurately on Form 1040. Specifically, you will need to use Schedule 1, where taxable income from various sources is reported.

It is also essential to understand the potential for adjustments to your state tax refund. Sometimes, the state may adjust your tax refund, leading to a different amount than what you initially anticipated. In some cases, the state might send a refund for a different amount than originally expected, which could lead to confusion when matching amounts with records.

Moreover, there are instances where taxpayers may not receive the expected amount due to various reasons, including interest paid on the refund amount, or adjustments made by the state. For example, you might receive a state tax refund, but the state's final calculation might result in a lower amount being issued, like in a situation where the state only sent you $570. Or, the state may have adjusted your refund but also paid interest on the amount, leading to a total close to what you expected to receive.

- Go Kyung Pyos Wife Unveiling The Life Behind The Actors Story

- 607 Unc Net Worth Unveiling The Mystery Millions

For those who haven't received their refund, the process for reissuing a missing, lost, or destroyed refund check involves certain steps. You can initiate the refund check reissue process by signing a refund reissue letter. This formalizes the request and starts the procedure to recover your funds.

If you believe that your tax identification number has been stolen and someone has filed a state tax return under your Social Security number, taking prompt action is crucial. In such cases, you should fill out the "Report Possible Tax Refund Fraud" form. This is a critical step in safeguarding your identity and finances.

Here is some additional information in the form of a table that summarizes key aspects of state tax refunds:

| Aspect | Details |

|---|---|

| Tax Benefit Rule | If you benefited from deducting state and local taxes in a prior year, any refund must be reported as income. |

| Taxable Portion | The portion of the refund that corresponds to the deductible amount from the prior year is usually taxable. |

| Reporting on Form 1040 | Report your state tax refund accurately on Form 1040. Use Schedule 1 to report taxable income. |

| Adjustments by the State | The state may adjust your tax refund, resulting in a different amount than expected. |

| Missing Refunds | Initiate the refund check reissue process by signing a refund reissue letter. |

| Tax Refund Fraud | If you suspect tax refund fraud, fill out the "Report Possible Tax Refund Fraud" form. |

Understanding the information related to state refunds is critical for all taxpayers.

The process of managing your taxes doesnt end with filing; accessing and managing your tax information online can be incredibly useful. Oftentimes, you can access your tax forms online via a secure account where you manage your benefits. This enables you to review your previous returns, access important tax documents, and track the status of your refund.

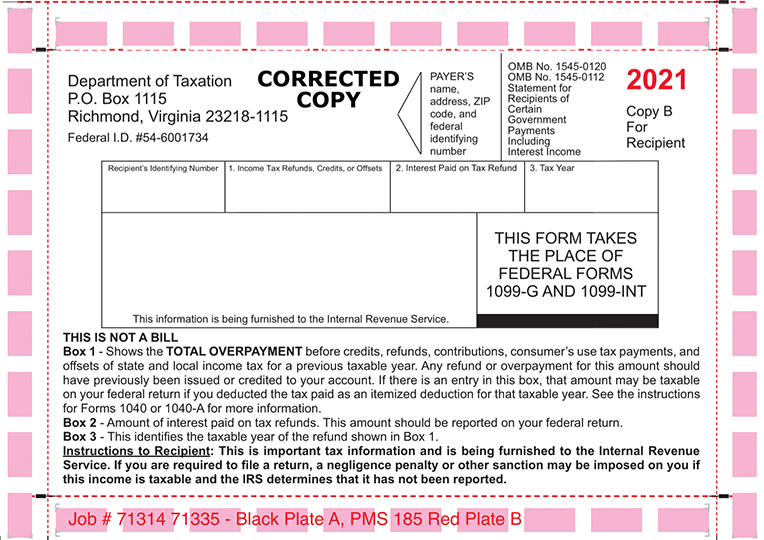

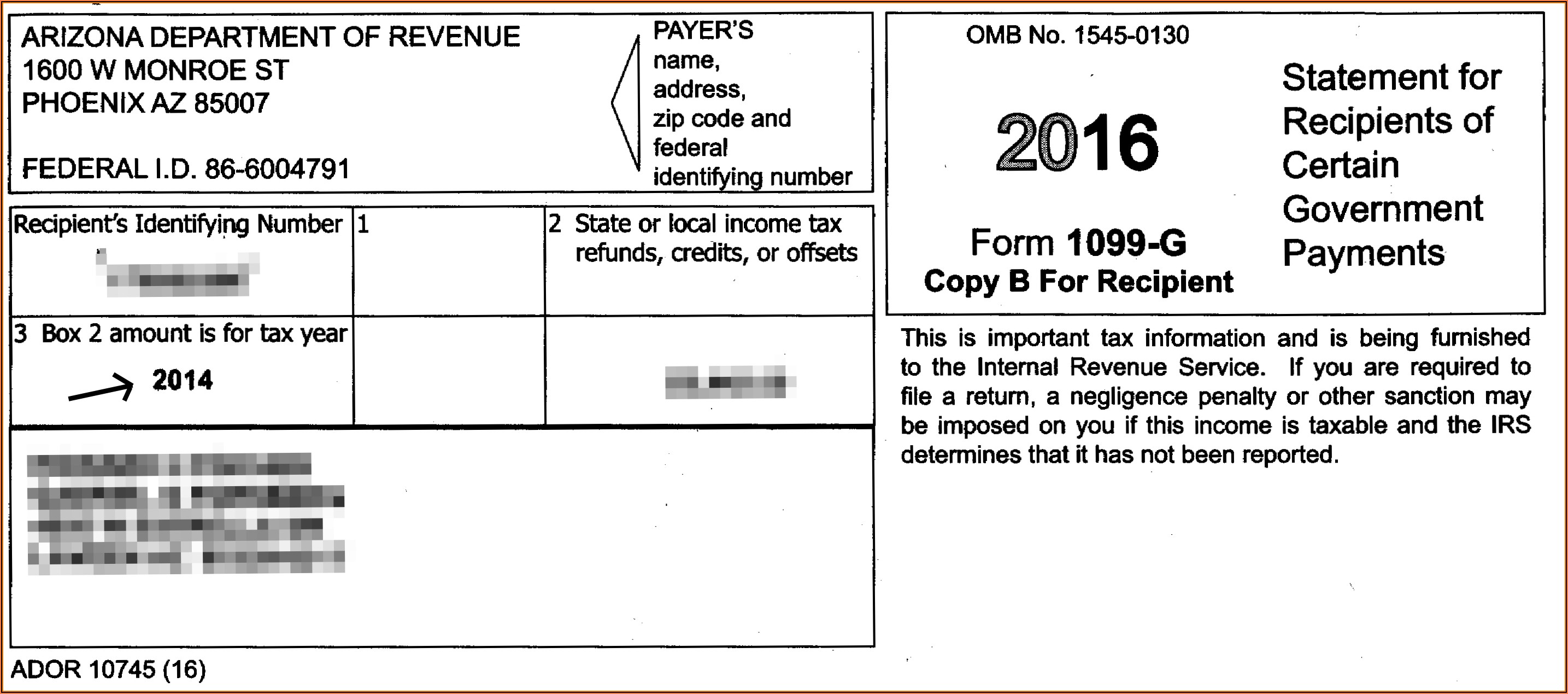

Clients don't always provide the 1099-Gs required for the state refunds, which can lead to delays while waiting for the necessary EINs and addresses that appear on the 1099-Gs. If you are waiting for the information on the form 1099-G, here is the list of necessary information for all of the states\u2019 1099g.

For example, if you have overpaid withholding tax from a previous year, this overpayment can be addressed by filing a claim for a refund using form DR 0137. Carefully check the instructions on your tax form to learn how to report unemployment benefit income and any amounts that were repaid.

In 2024, during the process of tax reporting, be prepared to answer the question: "Did you get a state or local tax refund?" You will need to enter the total refund received in 2024 on the appropriate screen.

For those receiving unemployment benefits, the division provides monthly records of your repayments, allowing you to determine the total amount repaid during the year easily. Consider the importance of accuracy and the potential implications of misreporting, and you will see why understanding these elements is essential for correct tax reporting.

There are further options in dealing with tax issues, such as filing your individual income tax return, submitting documentation electronically, or even applying for a PTC rebate. This flexibility empowers taxpayers to manage their tax liabilities according to their needs and circumstances.

Each tax type has specific requirements regarding how you are able to pay your tax liability, which is essential for proper compliance. Many states provide online tools and services, like the "Revenue Online" portal, allowing you to manage your tax account, check the status of your refund, and update your address details.

To find the amount of your state or local tax refund, refer to your state or local tax return for the tax year of the refund. Look for a line near the bottom, frequently bolded, that includes the phrase "total payments" or a similar designation. This will give you the critical figure you need for accurate tax reporting.

Tax preparation is important because of the tax benefit rule. When you itemize deductions on a federal tax return, one of the deductions is for state tax paid that year. But if you later got a refund from the state, that means you took too big a deduction. Since you got the refund in 2023, it is taxable in 2023. In such cases, only the portion of the refund that corresponds to the deductible amount is taxable.

Detail Author:

- Name : Sasha Schulist

- Username : mhaag

- Email : krajcik.trevion@gmail.com

- Birthdate : 1977-01-09

- Address : 348 Clare Falls Apt. 814 East Aronstad, MI 52101-7463

- Phone : +1.657.394.6315

- Company : Funk-Rohan

- Job : Sawing Machine Setter

- Bio : Et aut sed rerum similique cumque sunt sequi. Quae enim vitae aperiam omnis mollitia. Maxime numquam quidem dolores esse est dolor. Fugiat aut iusto expedita pariatur nemo.

Socials

twitter:

- url : https://twitter.com/casperk

- username : casperk

- bio : Aliquam hic qui rerum et eum ea aliquam facilis. Non impedit qui ratione quia consequatur. Facere qui aut eos omnis eaque ad. Iste amet animi quisquam.

- followers : 401

- following : 333

linkedin:

- url : https://linkedin.com/in/kareem6057

- username : kareem6057

- bio : Iste neque enim perferendis vel ad.

- followers : 574

- following : 2840